flow through entity llc

WHAT IS A FLOW-THROUGH ENTITY. S corps are pass-through taxation entities.

Llc Taxes How Is An Llc Taxed Truic

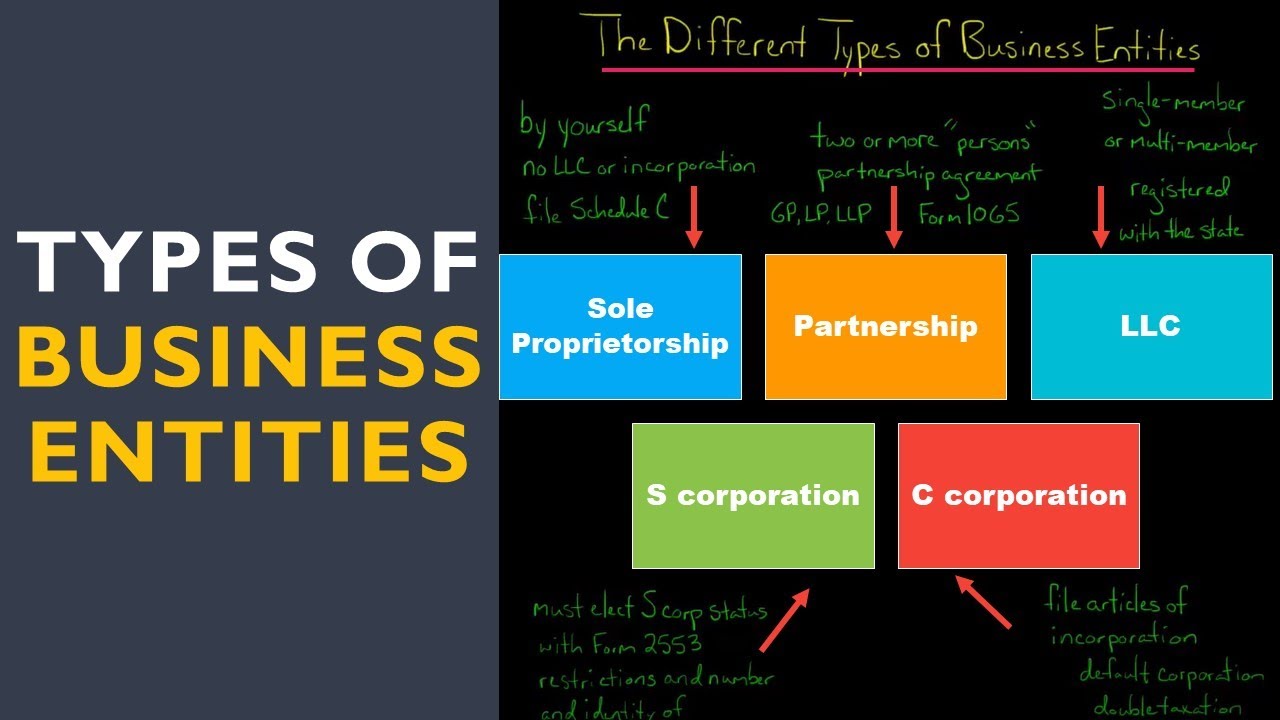

Before the Tax Cuts and Jobs Act most closely-held businesses were set up as flow-through entities to avoid the double taxation of C corporations but now many are thinking.

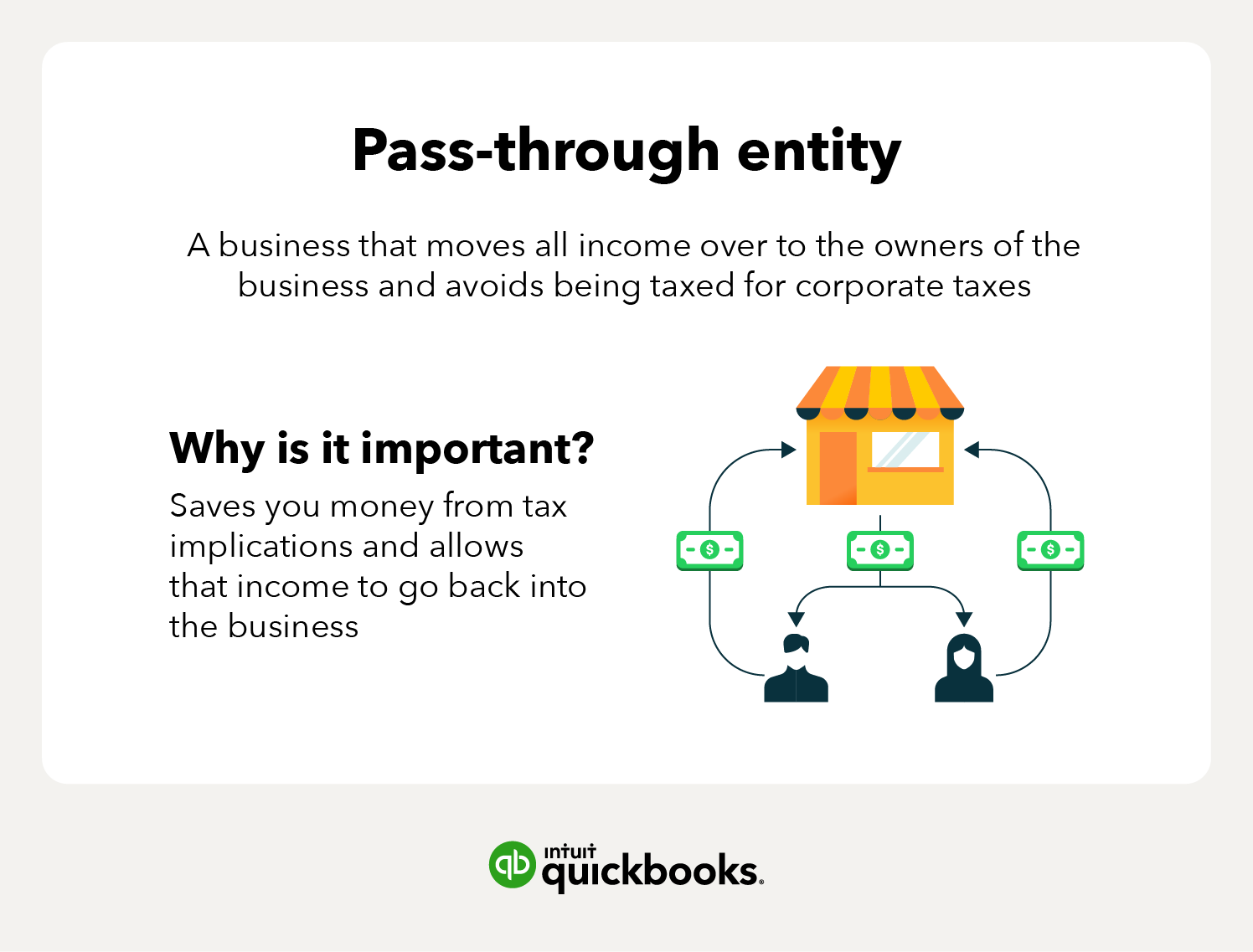

. The profitslosses of the. Federal income tax purposes or subject to. A flow-through entity is also called a pass-through entity.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. A travel through component is a legal business where pay travels through to owners or monetary patrons. To C or not to Cthat is the question for many business ownerswhether tis nobler to organize as a flow-through entity with future planning flexibility.

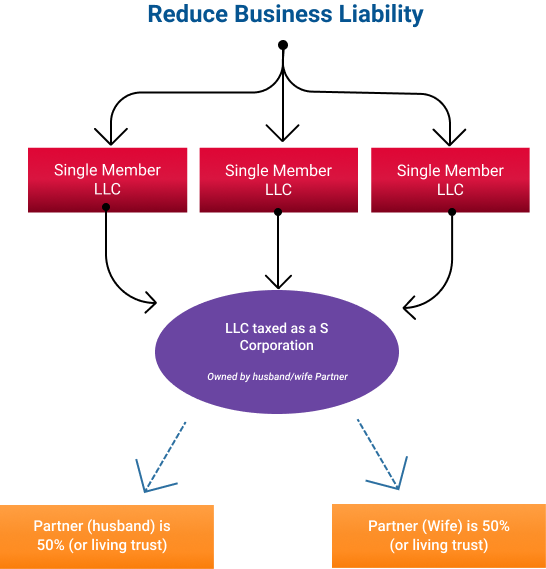

LLC flow-through is a business structure that passes the profits losses credits and expenses to the owners of the company. Ability to designate income as salary or distribution. This 500 donation will flow through to be included with any other personal charitable donations that Member made in that taxable year and will be jointly subject to any.

It is used to avoid double. Flow-through taxation allowing profits to pass through to the personal tax returns of shareholders. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

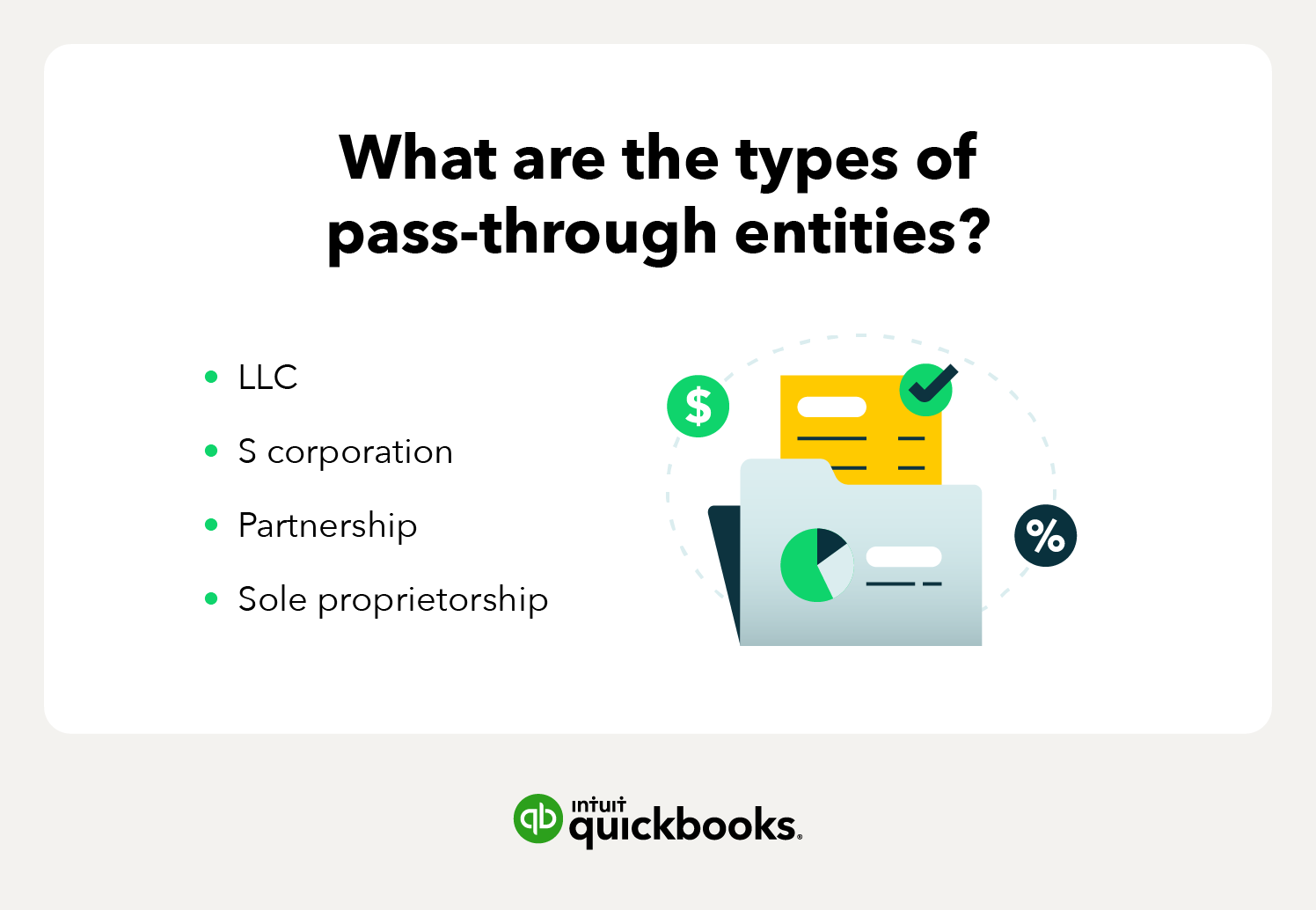

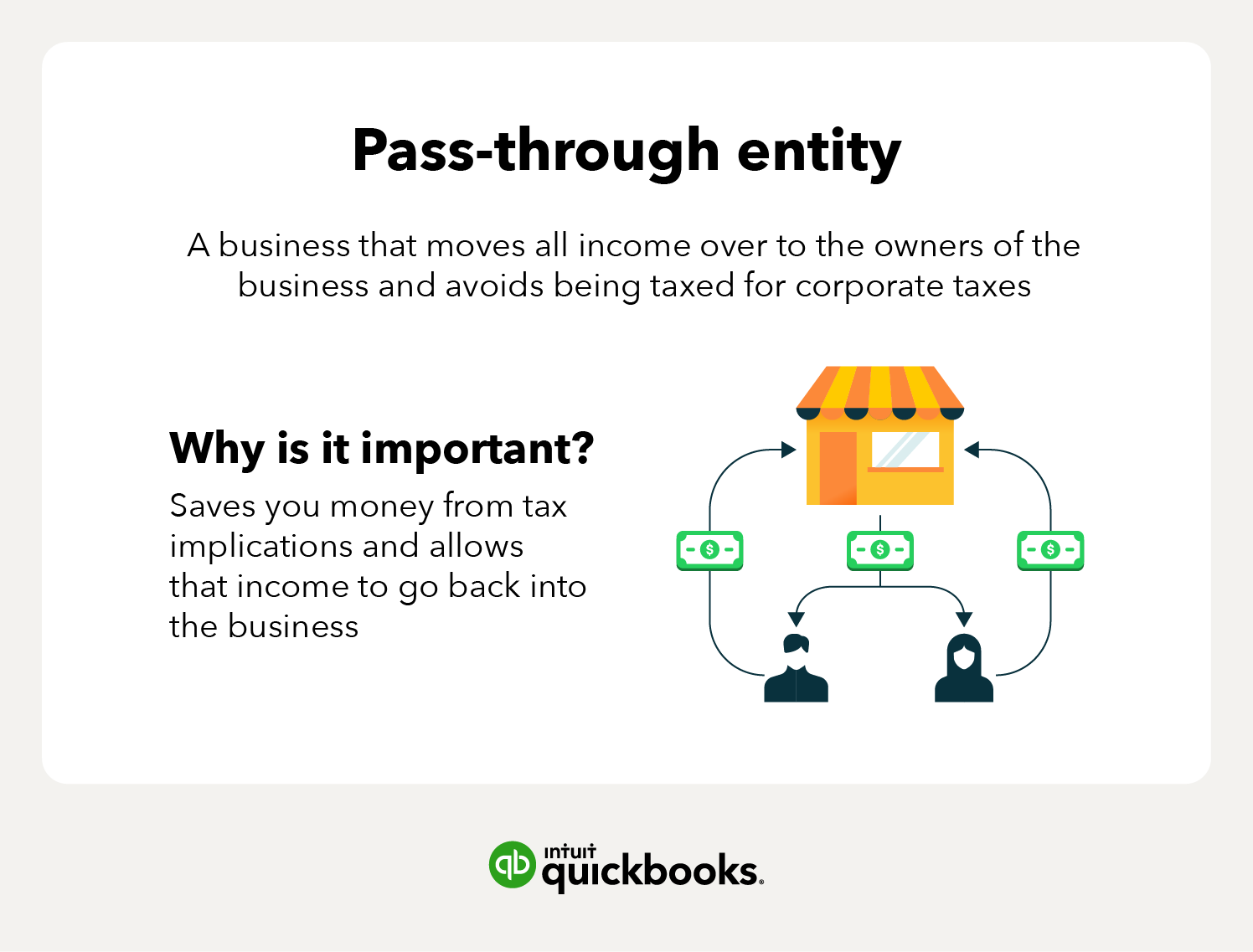

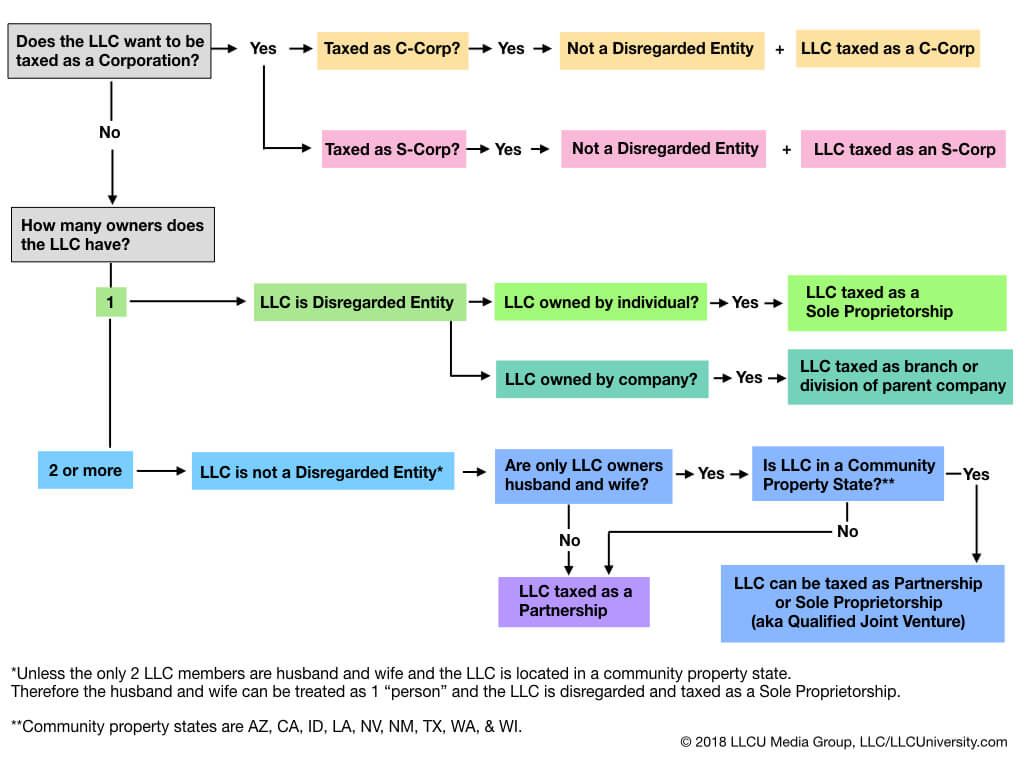

An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. Flow Through Entities Owned by Residents of Canada In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow.

They file an informational federal return Form 1120S but no income tax is paid at the corporate level. Flow-through entities are common businesses to. A pass-through entity also known as flow-through entity is a business structure in which business income is treated as personal income of the owners.

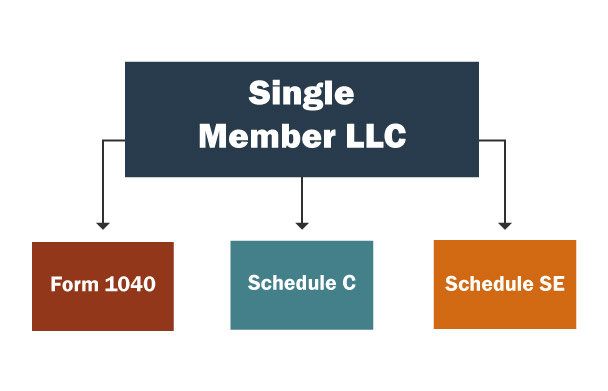

LLCs with only one owner single-member LLCs or SMLLCs are sole-proprietorships for tax purposes with income and expenses flowing through to Schedule C of the members personal. Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity.

As a result only the individuals not the business are taxed.

What Is A Series Llc And How To Structure It Incnow

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Pass Through Entity Definition And Types To Know Quickbooks

Pass Through Entity Definition Examples Advantages Disadvantages

Which State Is Best To Incorporate Your Business

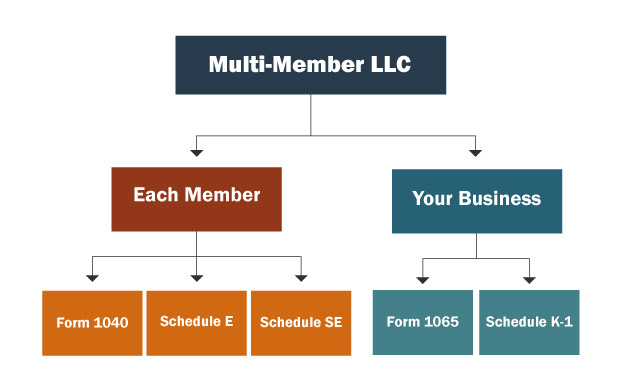

Multi Member Llc Taxes Llc Partnership Taxes

Choice Of Entity Choosing The Right Business Structure

Starting A Company Llc Vs Corporate Considerations Rubicon Law

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

Us Llc For Non Us Residents Foreigners 2022 Guide

Flow Through Entity Overview Types Advantages

Pass Through Taxation What Small Business Owners Need To Know

Pass Through Entity Definition And Types To Know Quickbooks

Are You Using The Best Entity Structure For Your Farm Agweb

Llc Vs C Corp Everything You Need To Know Unstack Inc

What Is A Disregarded Entity Llc Llc University

Business Entity Comparison Harbor Compliance